Trading is so much like golf. There is no “perfect”. There’s always room for improvement no matter your skill level and just when you think you’re onto something big, it’s probably time for you to be humbled. In both golf and trading, it’s all about continual improvement and learning. A never ending journey. I think that’s why I’m drawn to both.

To be successful in both endeavors, you need to avoid danger and when you find it, get out as fast as possible. In golf, one terrible hole can ruin an otherwise good round like one bad trade can put you in a deep hole. Sometimes the possibility for danger in trading is known (earnings days, bad market, etc.). But sometimes it comes out of “nowhere”. If you play this game (trading or golf) you need to know this is always a possibility. If you’ve been doing it for a long time, I’m sure you’ve experienced unwelcomed surprises that quickly humble you but maybe not if you are newer. You will.

The key is to always know this is a possibility. Don’t put all your hopes in a stock or a trade thinking it’s going to change your life. They can treat you great sometimes but always know they have to potential to do something unexpected. When something bad happens don’t be stubborn and make a bad situation worse.

It’s so important to define your risk (set stops) before entering any trade and use that risk to determine the position size. Basically, you want to know what your “max” loss is going to be if things don’t work out as you hoped. Being mechanical about this is important as it removes a lot of negative emotion. Trust me, I get so many stops hit it doesn’t bother me a bit. Well maybe a little sometimes, but I get over it quick. Protecting your capital is the most critical aspect of trading so this is part of it.

Sometimes plans get thrown out the window though. What then? Like golf, sometimes you rip a drive right down the middle on a really tough hole. You feel pretty good as you leave the tee box, everything is going to plan, and then as you arrive at your ball you see it’s in a divot. Not one of those shallow sand filled divots that allow you to pull off a good shot. I’m talking about a big deep hole. Tough break. You did everything right and yet you are still penalized. Well it happens. You need to get over it. Chunk it out of there and salvage the best score you can make on the hole. After all, it’s just one hole in a whole round of golf of many rounds in your life.

The same lesson can be applied to trading. Sometimes you find yourself in a huge loss when there was nothing wrong with your execution. Same lesson. Get out and fight on. Preserve your mental capital.

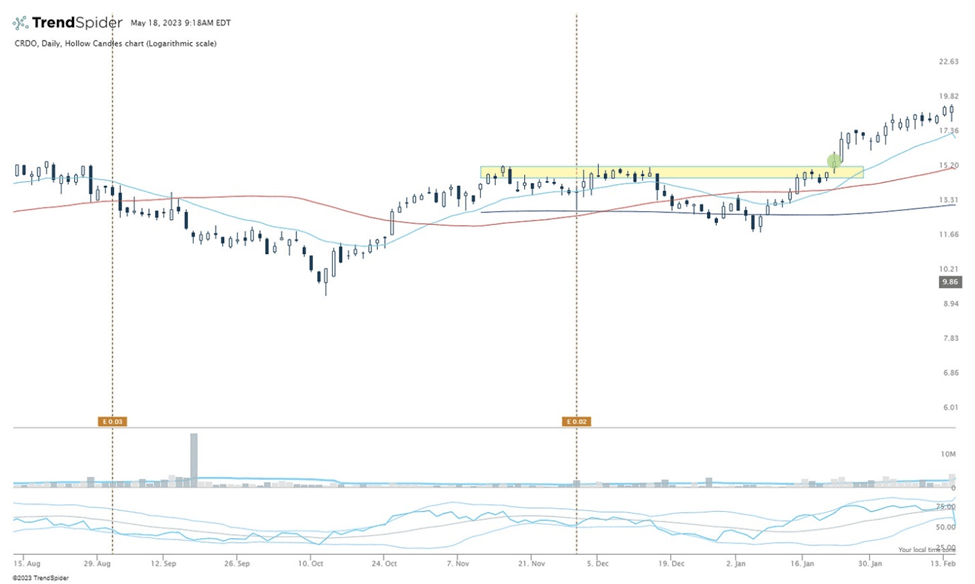

I had one of those drives down the middle into a huge divot earlier this year with CRDO. I got in that when it broke out in late January (green circle below). A nice entry, I’d take again. The stock was in an uptrend and it had a slight pause / dip before breaking out. I need that as a level to manage risk and my stop was under the low the previous day. Position size wasn’t huge here for me as the stop was a little wider than I typically prefer but I wanted in. Over the next few weeks, this moved nicely. About 20%. I took some gains along the way cutting my position in half (I like to book gains early then try to be patient with the rest). Chart’s below. Looks nice right?

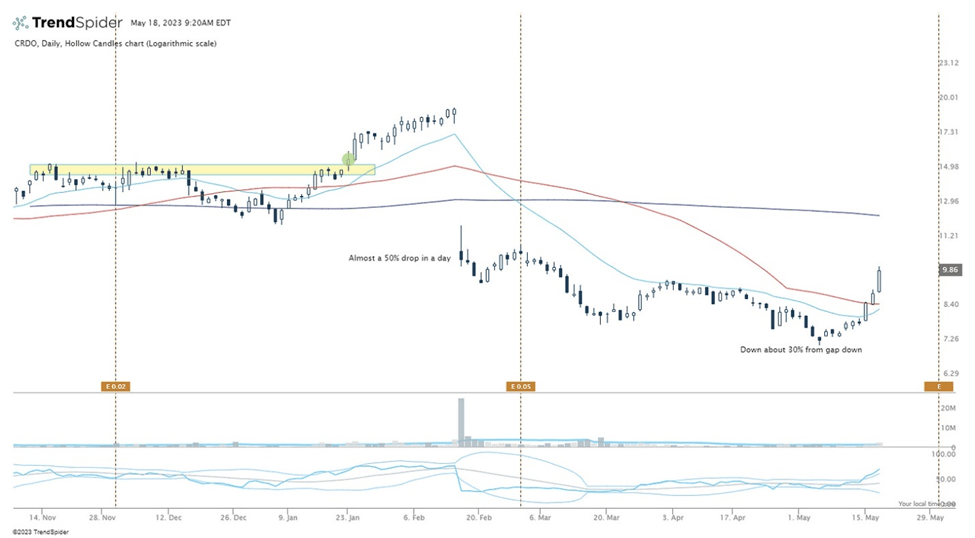

Well that all changed the next day. February 15th. The company announced they’d see reduced demand from their largest customer and the stock dropped about 50%. Ouch. Even though I had followed my plan, sold some along the way, and didn’t have a large position on, the 50% drop left more than just a scratch in my portfolio. A big old divot. Here’s the chart:

Year’s ago, I would have no clue how to handle this type of drop. Do I wait, do I buy more? For me the answer to both of these is no. Well kind of. I did wait a little. When the stock opened I wanted to see what it would do the first few minutes. I knew I was going to get out that day but maybe if it started bouncing, I could gradually raise my stop to salvage a few bucks. So I didn’t sell on the open but no bounce came so I was out shortly after.

Although this trade negatively impacted my portfolio it didn’t really bother me. Why? It wasn’t an execution issue on my part. Trust me, I make plenty of those. This wasn’t one of them. I traded my plan but had some terribly bad luck. And I was at peace with selling my shares for the huge loss allowing me to reset. Turns out it was the right move. Although CRDO has been creeping back up lately, it did drop another 30% from that gap down. Just like in golf, if you find yourself in trouble, don’t be a hero. Get out of trouble immediately and play on. There’s always the next shot.