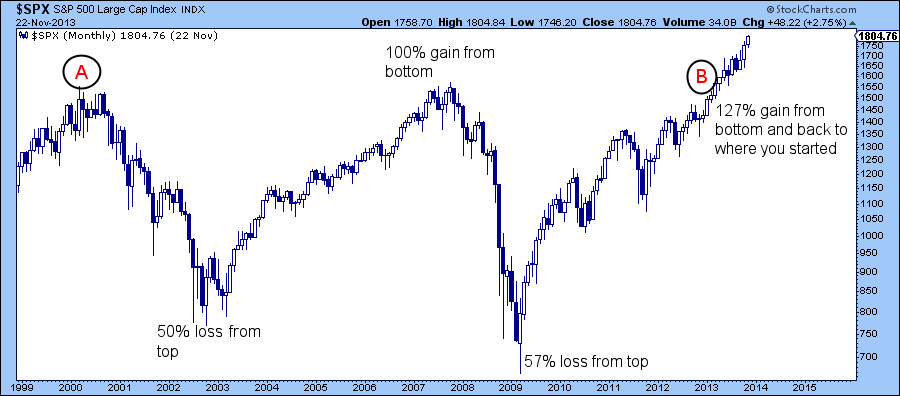

It seems like it’s been beaten into everyone’s head that passive “buy and hold” strategies are the only way to make money over the long term. I’ll be the first to admit, dollar cost averaging into passive investments is a great strategy that is extremely hard to beat, especially over an extended time period. However, I’d argue that this type of approach can also be quite dangerous. Look at this chart of the S&P 500 from 1999-2014.

What do you see? I see it took 13 years to get from point A to point B ending up at the same place you started. I see a buyer and holder at A waiting 8 years to recoup his initial investment only to see it lost again and waiting a few more years to get back to break even at B. What if in 1999 he decided he was going to retire in a few years? Look how long it takes to make back what he previously had. The mathematics of losses is very powerful. It takes a 100% gain to bounce back from a 50% loss! Gains and losses are not equals. This is why protecting against these big losses is so important and buy and hold does not help you here.

I know this is an extreme example, but the lesson is important. You can’t control what happens in the markets or to an individual stock you own but you can control your actions and inactions.

Clearly it’s impossible to catch every move. No one can time all large market moves perfectly or nail tops and bottoms. However, I believe it’s very possible, with a little work and patience, to catch a good portion of these major trends and be able to get out, or even go short, when the primary trend turns against you. If your goal is to maximize your money by using the power of compounding over a number of years, buying at A and holding to B does not seem like a good strategy in my opinion.

1 thought on “The Case for Active”