Simple. That’s what I really want in trading. From simplicity comes confidence—to act or not to act—and to be at peace with the outcome either way.

But finding your version of simple isn’t easy. That’s true for most traders. Everyone’s timeline varies. Mine took longer. Yours doesn’t have to. There’s a wealth of information out there and many experienced traders willing to share. Take advantage of that—but remember: Your simple is yours, not someone else’s.

Ben Hogan, a golf legend and arguably the best ball striker of all time, once responded to a question about the secret to his swing with:

“The secret is in the dirt.”

Translation – there is no secret. Just hard work. He found what works for him through endless hours on the range. Trading is no different.

Yes, you can accelerate your learning curve through books, videos, mentorships, or proven strategies. But ultimately, you have to figure out what fits your personal makeup.

What Works for Me

I’ve traded stocks in just about every way and tested hundreds of strategies over the years. When I stick to the principles below, I trade with more confidence, take lower risks, and my equity curve tends to move in the right direction. I still experiment and tinker occasionally – but only in a separate, smaller account.

None of these are revolutionary. In fact, they are quite common among traders but I’ve found them to work for me and when I get away from these (it happens, I’m not a machine) my performance suffers. Here’s what keeps my trading simple and effective:

1. Stick to Uptrends

I use the 200- and 50-day simple moving averages and the 21-day exponential moving average to identify trends. I like them all sloping up. There’s no magic in the MAs themselves—but lots of traders watch them, which gives them more importance. Price tends to respect these areas. Put the wind at your back. No reason to fight against the market. Simple.

2. Define Your Risk – Always

Before I enter any trade, I know exactly where my risk is. I zoom into a 30-minute chart to refine my entry and place my stop just below a recent swing low. That’s the point where I no longer want to be long. Years of following Brian Shannon, an excellent teacher whose approach and education provided is a lifelong gift, really helped drill this into my head.

Position size? I size based on the risk I’m taking on given my stop level. I rarely risk more than 0.5% of my portfolio on any trade.

Remember: chart-defined risk is critical to planning a trade, but overnight events happen. That’s why I avoid taking large (10% is my typical full size) positions upfront, even when the setup looks ideal. Case in point: HIMS on June 23.

Strong chart trending up. Then came the gap down. A good reminder – just like in golf, sometimes you hit the perfect drive down the middle only to find your ball sitting in a big divot. You have to play it as it lies and move on. Same goes for trading or life for that matter.

3. Look for Consolidation

This builds on risk management and identifying lower risk trades. Consolidation in an uptrend signals a pause—a battle between buyers and sellers—that often precedes the next move. From contraction comes expansion. In an uptrend, that next move is usually higher. If it goes against you? That’s what stops are for.

4. Use Stop Losses

I set my stop right after entering. Since I can’t watch the market all day, I need this layer of risk control. Stops aren’t perfect, but they give me confidence to take positions knowing I don’t have to be in front of the screen to sell.

5. Trim on Strength

If a trade moves up 5–10% quickly, I’ll typically take some off the table. That reduces my exposure and allows me to tighten my stop on the remainder – usually closer to breakeven.

It also satisfies my urge to “hit a button,” locks in early profit, and helps me stay patient with the rest. The last part is the most important for me and critical to capturing large chunks of strong moves.

6. Raise Stops Over Time

For longer-term winners, I review my stops at least weekly. Raising stops brings a quiet kind of joy – locking in profits, reducing risk. It feels good. No “perfect sell rule” exists. You have to find your own balance between selling too early and giving too much back.

7. Be Confident

Confidence comes from simplicity and discipline. It doesn’t mean you’ll be right every time—far from it. But if your process is solid and your risk is defined, you’ll stay mentally strong.

Before every trade, I ask:

“Does this make sense?”

If not, I don’t take it. If yes, let’s go. No regrets or expectations of a certain outcome.

8. Focus on Relative Strength

Why over complicate it? Focus on stocks outperforming the market. This becomes especially important when building watchlists during corrections.

One of my favorite scans: 3-month relative strength vs. the market (e.g., VTI or SPY ETF).

A Real Example: Trading $HOOD

Let’s walk through a recent trade in Robinhood ($HOOD), using the process I’ve described.

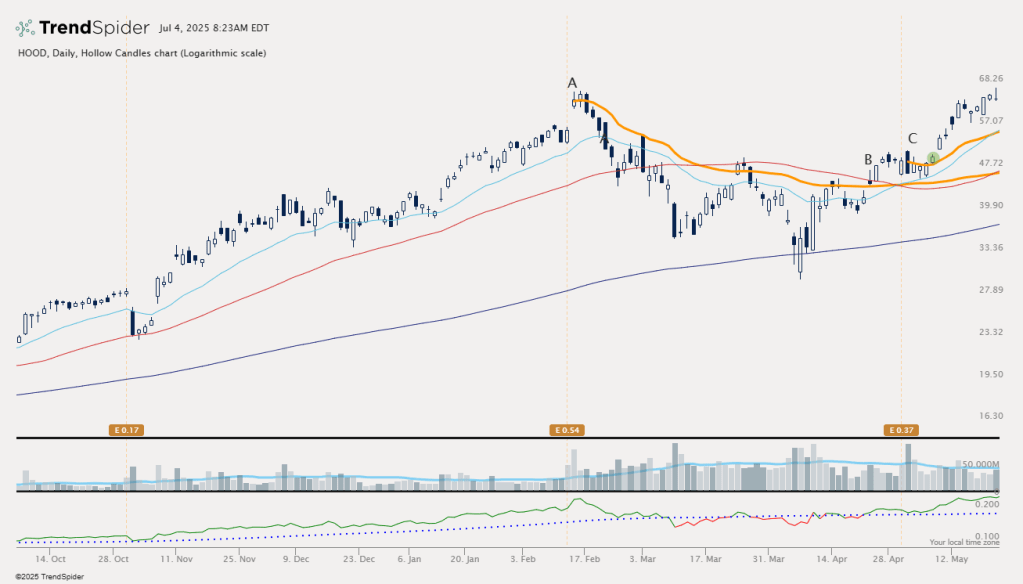

📈 Daily Chart

- Point A: Strong uptrend, gap up on earnings. Not actionable, but worth watching. I anchored a VWAP to the earnings gap. Price pulled back and stayed under the AVWAP for weeks. Nothing to do yet.

- Point B: Relative strength improving, approaching multi-month highs. 50-day MA flattening. I was tempted to enter—but with earnings ahead, I passed. Risk first, always.

- Point C: Post-earnings reaction was flat—perfect. 50-day MA started turning up. I anchored another VWAP to this earnings day. Now it’s time to zoom in.

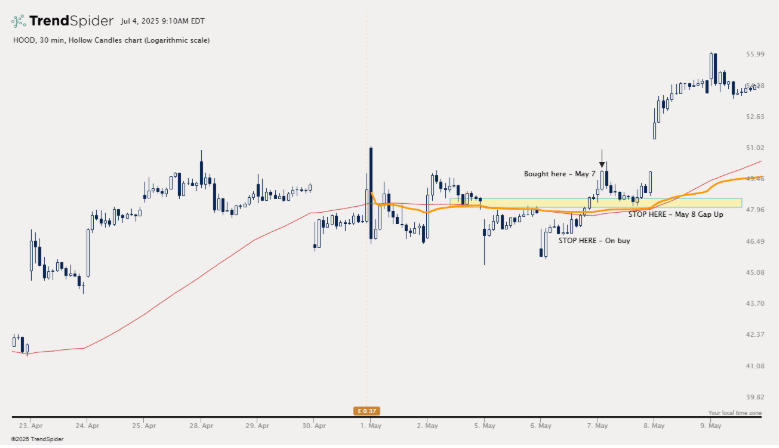

🕒 30-Minute Chart (Entry & Stop Setup)

The 5-day (65-period) MA is in red. The AVWAP from earnings is orange.

Price chopped around under the 5-day and AVWAP for a couple of days, so I set an alert above these levels (yellow box). Alerts are key—I can’t stare at charts all day, and I don’t need to.

- May 7: Alert triggered. I entered.

- Stop: Just under recent swing low (~$3 or 6% risk).

- Position size adjusted for the wider stop than I typically have.

- Stop: Just under recent swing low (~$3 or 6% risk).

- May 8: Got a lucky gap up.

- Raised stop under key levels (5-day and AVWAP).

- Sold ~25% of position for an ~8% gain.

- Raised stop under key levels (5-day and AVWAP).

This partial sell helped me stay hands-off and let the trade work. I gradually raised my stop as price respected the 21day EMA and 50 day SMA. I’m still holding and it’s just over a double from this entry.

Final Thoughts

This HOOD trade is just one example of how I size up a potential trade. This one has worked, but well over half of my trades hit their stop and I’m left with a loss. The key is keeping losses small and sticking to your plan. That preserves capital and confidence—so when the next good setup comes, you’re ready to act.

Keep it simple.

Focus on risk.

Trade with confidence.

Good trading!